The Association for Academic Excellence (Autonomous) has launched Programming_Lab, a state-of-the-art online Fintech Programming Laboratory. This first-of-its-kind initiative equips students and researchers with hands-on experience in financial research, bridging the gap between theory and practice through academic and industry collaboration .

Types of Engagement in Programming Lab

The three levels aims to equip Students, Teachers, First Time Programming Users aiming to understand Software Development, AI Engineering, and Software Architects with the clear understanding and practical tools needed to address complex real-life challenges.

Target Audience

Absolute Beginners / Non-Programmers

Target Audience

Developers / AI Engineers

Target Audience

Software Architects / Product Engineers

Foundational Python

Focus

Core syntax, fundamental data types, high-level understanding of control structures (flow control), and basic output layer delivery.

Goal

To enable learners unfamiliar with programming to quickly grasp the language and effectively communicate with computer or AI systems.

Outcome

Learners will achieve a lucid understanding of the Python language, enabling them to write programs that are readable and effectively execute tasks.

Functional Python

Focus

Functional programming concepts, in-depth exploration of algorithms used in Machine Learning (ML) and Artificial Intelligence.

Content

The mathematical and statistical foundations of key algorithms.

Understanding the hyperparameters associated with each algorithm and their impact on efficiency.

Hands-on practical experience in applying and calibrating these algorithms for specific use cases.

Audience

Developers, Software Architects, and AI Engineers who need to effectively select and implement relevant code to solve complex problems.

Professional Python

Focus

Bridging algorithmic knowledge with real-world system architecture and product delivery.

Core Concepts

Data Structures and Algorithms (DSA).

Foundational System Design.

Data Engineering principles.

DevOps, AI Engineering, LLMOps, and GenAI techniques.

Delivery

This module is delivered completely hands-on through real-life case studies. Users will gain exposure to:

Defining the problem based on a use case.

Understanding business requirements.

Creating relevant metrics.

Designing solutions that ensure technical implementation aligns end-to-end with the final business needs of the user.

Programming_Lab purpose

- Transform students into finance professionals

- Prepare for investment banking, private equity, asset management roles

- Bridge academic theory with industry practice

The projects

We appreciate projects tackling real-world business challenges, to be completed by team of three to four skilled students over the stipulated period. Most projects involve advanced technical skills like financial econometrics, simulation, derivatives valuation, optimization and related software and programming languages, while some focus on less technical aspects.

|Upcoming Projects

#Reinforcement Learning for Hedge Fund Strategy Selection

This project explores Reinforcement Learning (RL) in hedge fund strategy selection, using Proximal Policy Optimization (PPO) to optimize trading decisions dynamically. It challenges traditional models by demonstrating AI’s adaptability in financial markets. While offering superior performance, RL demands significant computational resources, highlighting both its potential and challenges in finance.

#AI-Driven Credit Risk Assessment for SMEs

This project explores AI-driven credit risk assessment for SMEs, addressing financing challenges worsened by COVID-19. By leveraging machine learning and big data, it enhances risk evaluation, improving loan accessibility while mitigating bank losses. However, ethical concerns like data privacy and bias must be managed to ensure fair and sustainable financial solutions.

#Machine Learning for Financial Risk Control

This project explores machine learning’s role in financial risk management, enhancing fraud detection and credit evaluation. AI-driven models improve accuracy but face challenges like data quality and interpretability. By refining these models, financial institutions can better manage risks, ensuring secure and reliable financial services while addressing ethical and transparency concerns.

|Ongoing Projects

#Hyperparameter Optimization in Portfolio Management

This project explores optimizing the Black-Litterman portfolio model using genetic algorithms to enhance investment strategies. By refining hyperparameters, it improves risk-return balance and diversification. While AI-driven optimization boosts performance, challenges like computational complexity and model sensitivity must be addressed for effective real-world financial decision-making.

Resources & Learning Support

Comprehensive Learning Modules

- Financial Analytics & Programming

- Data Science & Algorithm Development

- Mathematical & Statistical Foundations

Specialized Courses & Workshops

- Hands-on training in AI & ML-driven finance applications.

- Master essential financial research tools.

- Participate in interactive workshop series.

Interested in Joining Programming_Lab?

If you are interested in joining a project in Programming_Lab, please email to contact@aeindia.org

Eligibility

- MBA, B.Tech , MSc (Financial Economics), MSc (Finance)

- Finance and coding background preferred

- Competitive application process

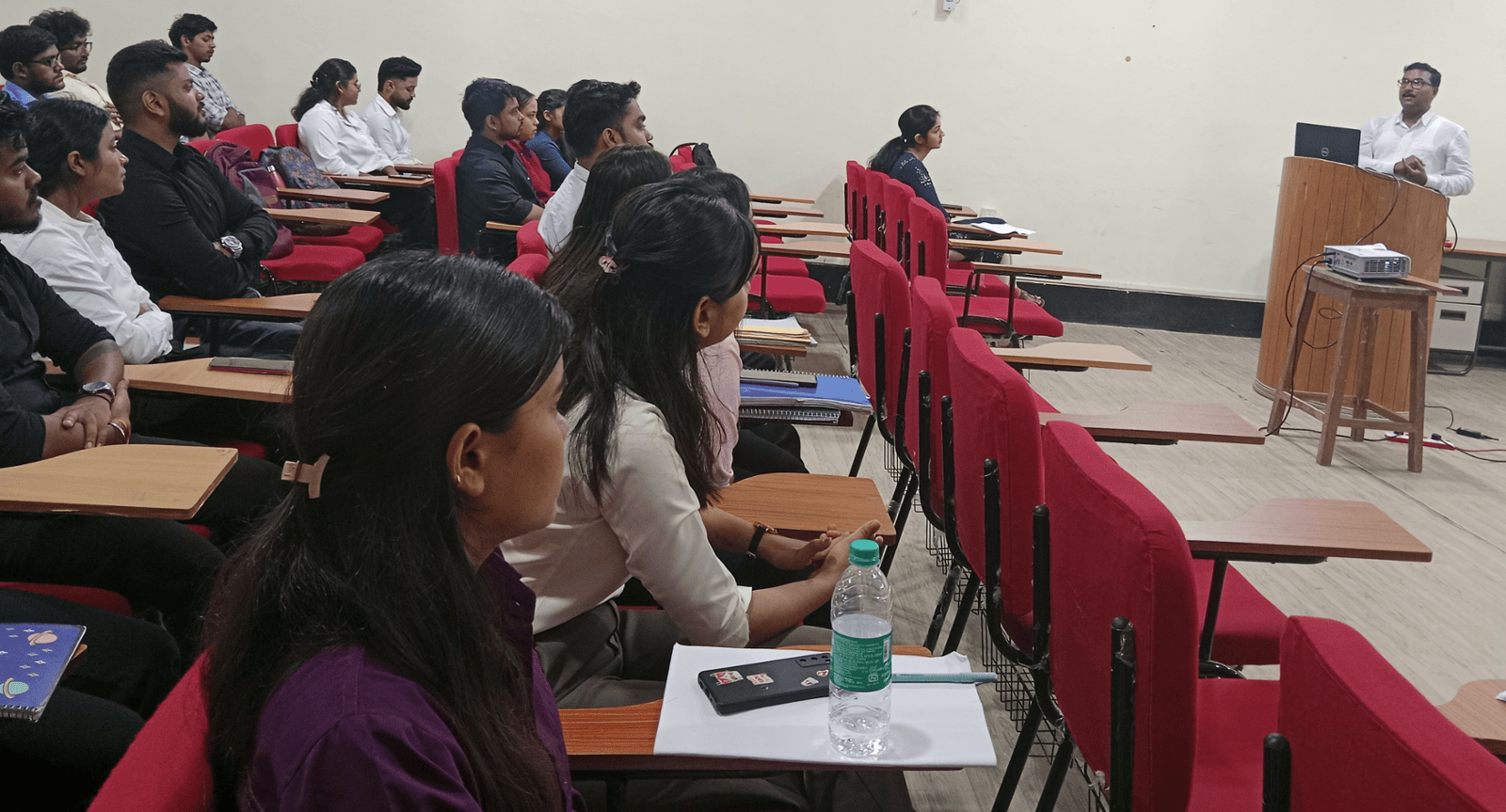

Training at Programming_Lab

Students of finance lab will be trained in a variety of open source software tools and Programming languages along with publicly available data sets for research and product development .

Programming_Lab Participation

FAQs

Prog_Lab Orientation

AI and ML in Finance

- Online and in-class training

- Real-world case studies

Practical case based learning

- Two-hour expert-led sessions

- Case studies

- Networking opportunities

Fintech Research

- Fintech Research Orientation

- MLOps and AIOps

Application steps

1.Initial Application

- Submit a detailed CV

2.Review Process

- Programming Lab team evaluates applications.

- Assess candidate’s background and potential.

- Provisional acceptance based on initial review.

3.Online Courses

- Provisionally accepted candidates complete mandatory courses.

- Demonstrate required financial skills and knowledge.

4.Final Selection

- Successful completion of courses and exams.

- Final confirmation of programme participation.

Programming Lab Mentor

"Participation in the Prog_Lab will encourage each of us to co-create fintech products and Research Ideas"

Contact

We are Here to make a Happy Learning Ecosystem